Why the Boston Housing Market Isn’t Crashing

Everyone keeps waiting for a housing crash — but here’s the truth: it’s not coming. The market isn’t collapsing… it’s frozen. And for relocation buyers, the biggest mistake I see is waiting for a crash that simply isn’t showing up in the data.

I’m Jeni Lu, and I help relocation buyers who are moving to Boston make smart, data-driven decisions — with strategy, not headlines.

And look… I get why people hope for a big price drop. I really do.

I bought my first home back in 2009, when the housing market truly felt like it was on clearance. Prices were low. Inventory was everywhere. It was an amazing time to buy — and honestly, I’d love to see those days again.

But today’s market isn’t 2009. It’s a completely different reality.

Table of Contents

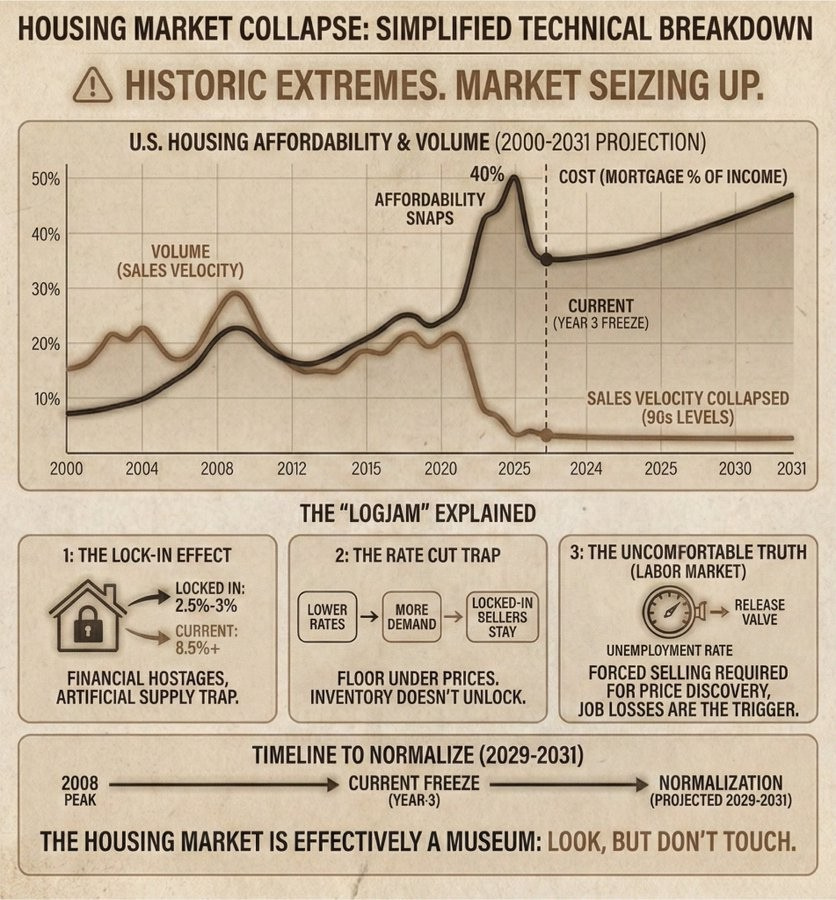

The Lock-In Effect: Why Sellers Aren’t Moving

Today, millions of homeowners are locked into ultra-low 2–3% mortgage rates, which you can clearly see when you look at historic mortgage rate trends (Freddie Mac PMMS) — and that’s a big reason so few people are willing to sell and give up those rates.

so they’re not moving. That means fewer homes hit the market, sales slow down, and yet prices remain sticky — and in many areas, they’re still rising.

This isn’t a crash.

It’s gridlock.

The Uncomfortable Truth Behind Price Declines

There’s another uncomfortable truth that most people don’t talk about.

Real price declines usually don’t happen in healthy job markets. For prices to truly reset, there has to be forced selling — and historically, that tends to happen when job losses rise. Real price declines typically don’t happen in healthy job markets. Significant corrections tend to follow periods of economic stress — especially rising unemployment — which is why I also look closely at Boston employment trends and job data (BLS) when analyzing the housing market.

In other words, job losses are often the real trigger for a housing correction.

And right now, that pressure simply isn’t there.

So instead of a crash, we’re seeing a market that’s stuck — frozen in place.

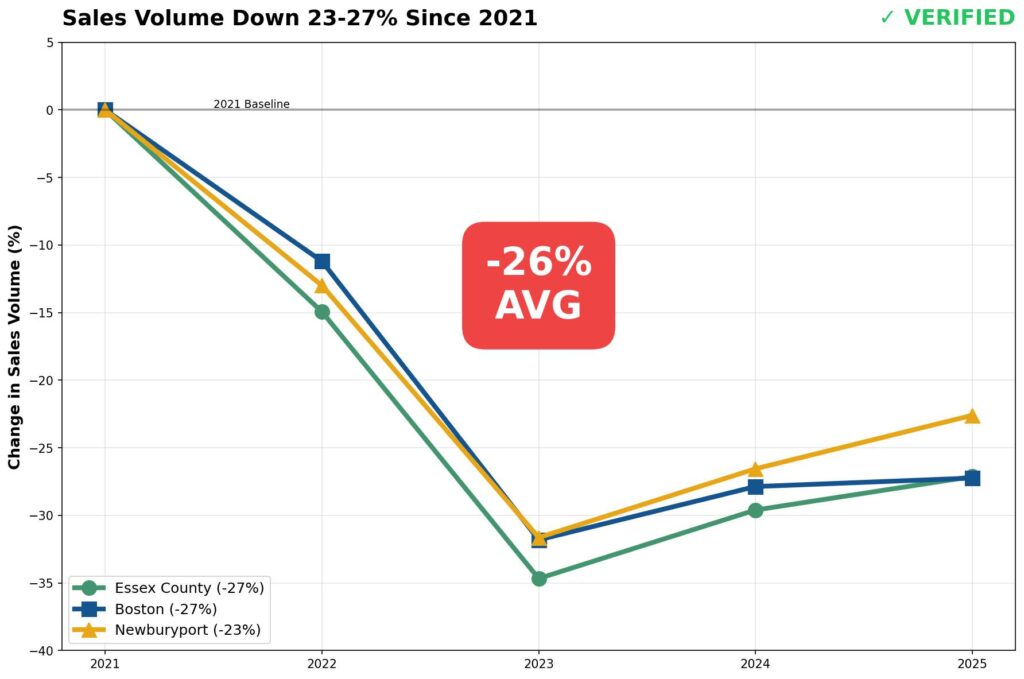

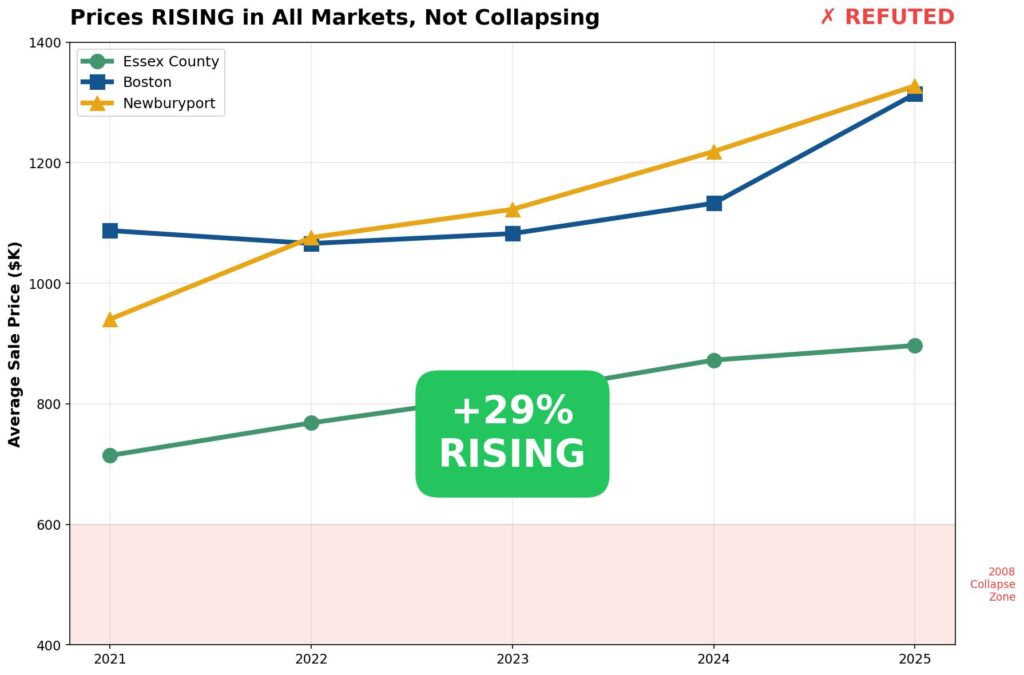

What Local Data Shows in Boston & the North Shore

When we zoom into our local numbers — Essex County, Boston, and Newburyport — we see the same pattern.

Sales are down. Inventory is tight. Days-on-market are up slightly.

Prices are still higher than just a few years ago.

Slower doesn’t mean cheaper.

What This Means for Relocation Buyers

If you’re relocating to this area, this matters — a lot.

Because waiting for a crash that never comes doesn’t usually equal savings. More often, it leads to:

fewer choices

higher prices later

missed opportunities

Meanwhile, the buyers who succeed in this market aren’t timing the market — they’re building strategy.

How Smart Relocation Buyers Are Winning Right Now

Here’s what my most successful relocation buyers are doing:

Getting pre-approved early so they’re ready to move fast

Staying flexible on neighborhoods — but firm on lifestyle priorities

Considering homes with light cosmetic upside instead of chasing perfect, ultra-competitive listings

Making decisions based on local data — not national headlines

In a frozen market, strategy beats timing.

My Role in the Process

My job isn’t to convince you to buy a home.

My job is to help you understand the reality of the market you’re stepping into — so you can make the right decision for your life, your timing, and your finances.

If you’re planning on moving to Boston, reach out. I’ll walk you through the trends in your exact price point and target town so you can move forward confidently.

You’ll also find my relocation guide here:

wickednorthshore.com/relocation